Source :- Shikshan Nivesh

How VA Tech Wabag quietly turned exits into expansion, and sewage into sustainability.

It started with a glance… and then a pause

I’ll be honest — when I first opened the Wabag investor deck, I expected boredom. A water EPC company that treats sewage and recycles wastewater?

This sounded like something out of a government RFP binder — not a public equity story. But I couldn’t look away.

There was something there. A kind of quiet competence.

Maybe it was their ability to turn around without a fuss — exiting Europe entirely and going full throttle in the Middle East.

Maybe it was their recurring annuity model slowly eating into revenue share.

Maybe it was the fact that no one was paying attention.

Whatever it was, I kept digging. And what I found was… something rare.

The Business Model No One Bothered to Understand

Wabag builds water infrastructure. Then they operate it. That’s it.

But simplicity can be deceptive.

There are two key verticals :

- EPC : They build sewage treatment plants (STPs), desalination, and industrial effluent systems.

- O&M : They then stay back and operate the same plant for 10–15 years, collecting recurring service fees.

The second bit is where the quiet magic lies.

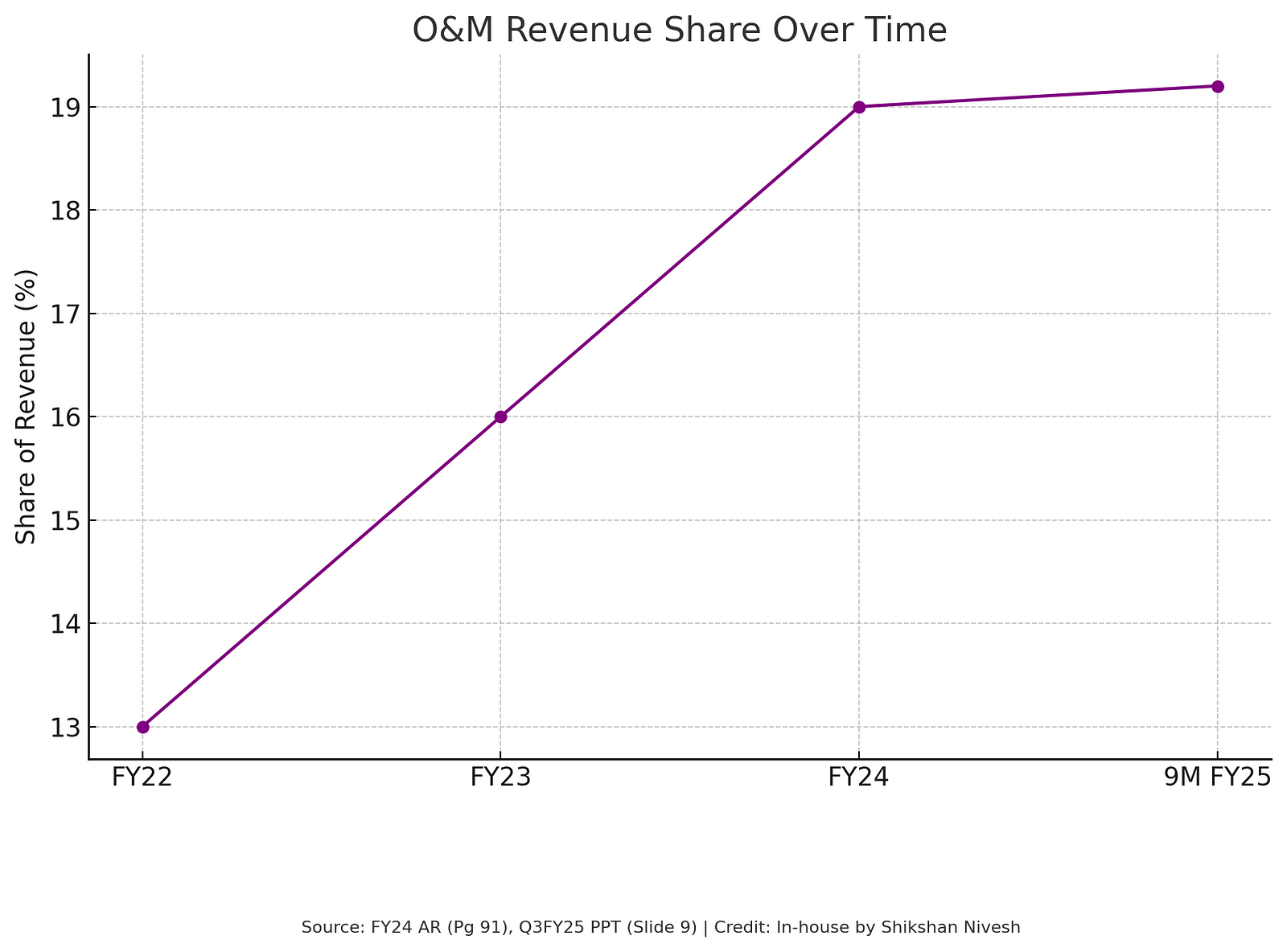

From just 13% of revenue in FY22, O&M now contributes over 19% in 9M FY25.

This shift isn’t just accounting. It’s durability.

While EPC orders fluctuate, these annuity contracts build resilience — the kind investors often don’t notice until a crisis hits.

The European Exit : A Pivot You Don’t See on the Balance Sheet

In FY21–22, Wabag was bleeding slow payments in Romania.

Receivables kept piling, cash flows kept choking. So they did what most wouldn’t:

They walked away from Europe.

One by one, they liquidated or exited subsidiaries across Austria, Switzerland, and Romania.

No headlines. No drama.

In their own words :

“We’ve consciously withdrawn from European EPC because the working capital cycle was unfavorable.” — Q2FY25 Concall

What followed was a complete pivot :

- ₹698 Cr Lusaka WWTP project in Zambia

- ₹863 Cr STP contract in Bahrain

- ₹3,251 Cr Saudi Al Haer order (₹1,725 Cr Wabag share)

They left Europe — and built momentum in markets that pay faster and execute harder.

Interlude : The Day I Realized “Execution” Isn’t Sexy — But It Saves Everything

A few years ago, I remember sitting with a friend who had just exited a ten-bagger. He was buzzing.

I wasn’t.

I had just spent two months analyzing a small infra firm that was doing everything right — slow growth, yes — but methodical, cash-generating, low-debt kind of right.

I remember telling him :

“This one’s not going to fly fast. But it won’t fall either.”

He looked at me and said :

“Bro, no one makes money on slow.”

That stuck with me. Not because I agreed — but because I wanted to prove him wrong.

Wabag reminds me of that moment.

It doesn’t shout. It doesn’t spike. It doesn’t trend. But it executes.

And over the long arc of investing, execution beats excitement — every single time.

Just Last Month, I Saw It Again

Just last month, I came across a contract Wabag had won — a ₹698 Cr project in Zambia for wastewater treatment.

Not a headline anywhere. No stock spike. No “breaking news.”

But there it was, buried on Page 8 of a quarterly deck :

A water treatment infra project, funded by German and European banks, across two Zambian towns.

And I smiled. Because that’s what Wabag does.

While others chase hype, they chase hydration. While others celebrate P/E compression, they compress debt cycles.

They’re like that one colleague you ignore in meetings — the one who stays back late, finishes the job, never asks for credit… but holds the whole team together.

You only realize their value after the chaos settles.

Wabag, to me, is that guy.

FY25 So Far — Flat Charts, Clean Performance

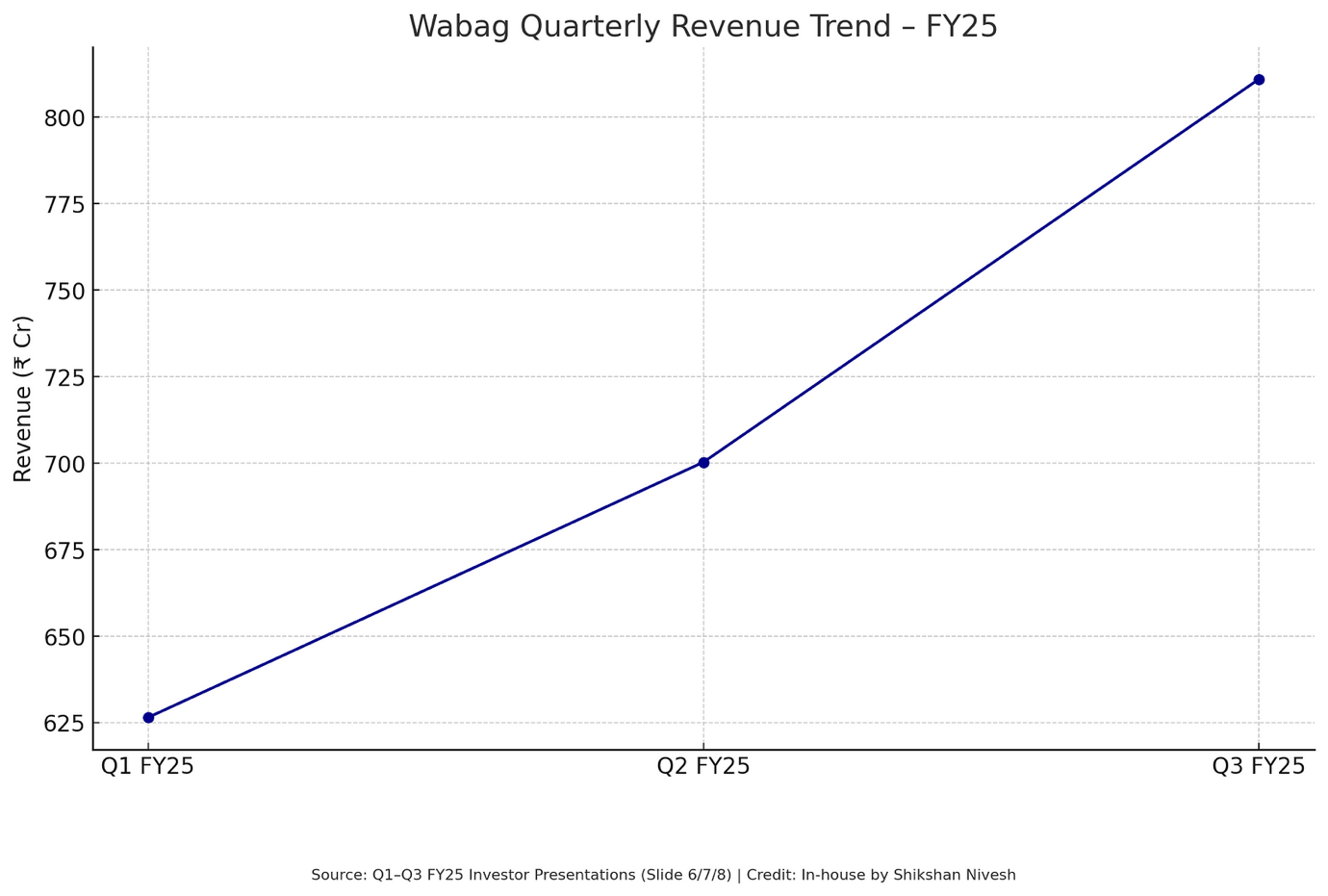

Three quarters into FY25, the numbers tell a clear story.

Revenue went from ₹626 Cr in Q1 to ₹811 Cr in Q3.

Margins have stayed consistent. PAT is slowly inching upward.

No blowout earnings. No euphoria. Just delivery.

Valuation Talk — Is It Really Cheap?

Let’s get this straight.

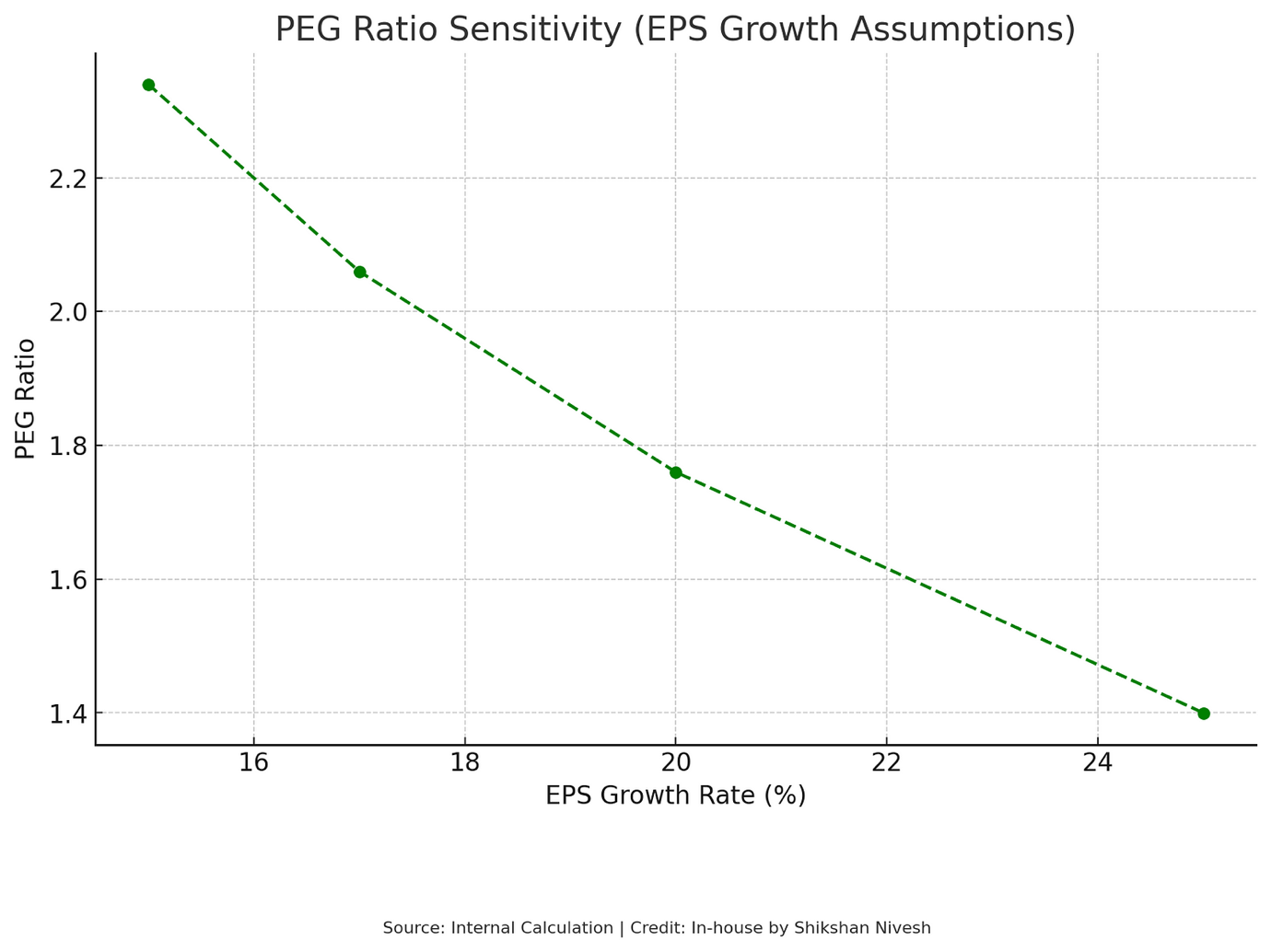

As of Q3 FY25, Wabag’s trailing EPS is around ₹39. Market price was ₹1,384 at last check — so P/E is ~35.5x.

PEG ratio? Well, that depends on how much growth you bake in.

Even with 17–20% growth, PEG is above 1.7x.

Not dirt cheap. But not speculative either.

You’re not buying hype — you’re buying a long-term infra model with global legs.

The World is Buying Their Water

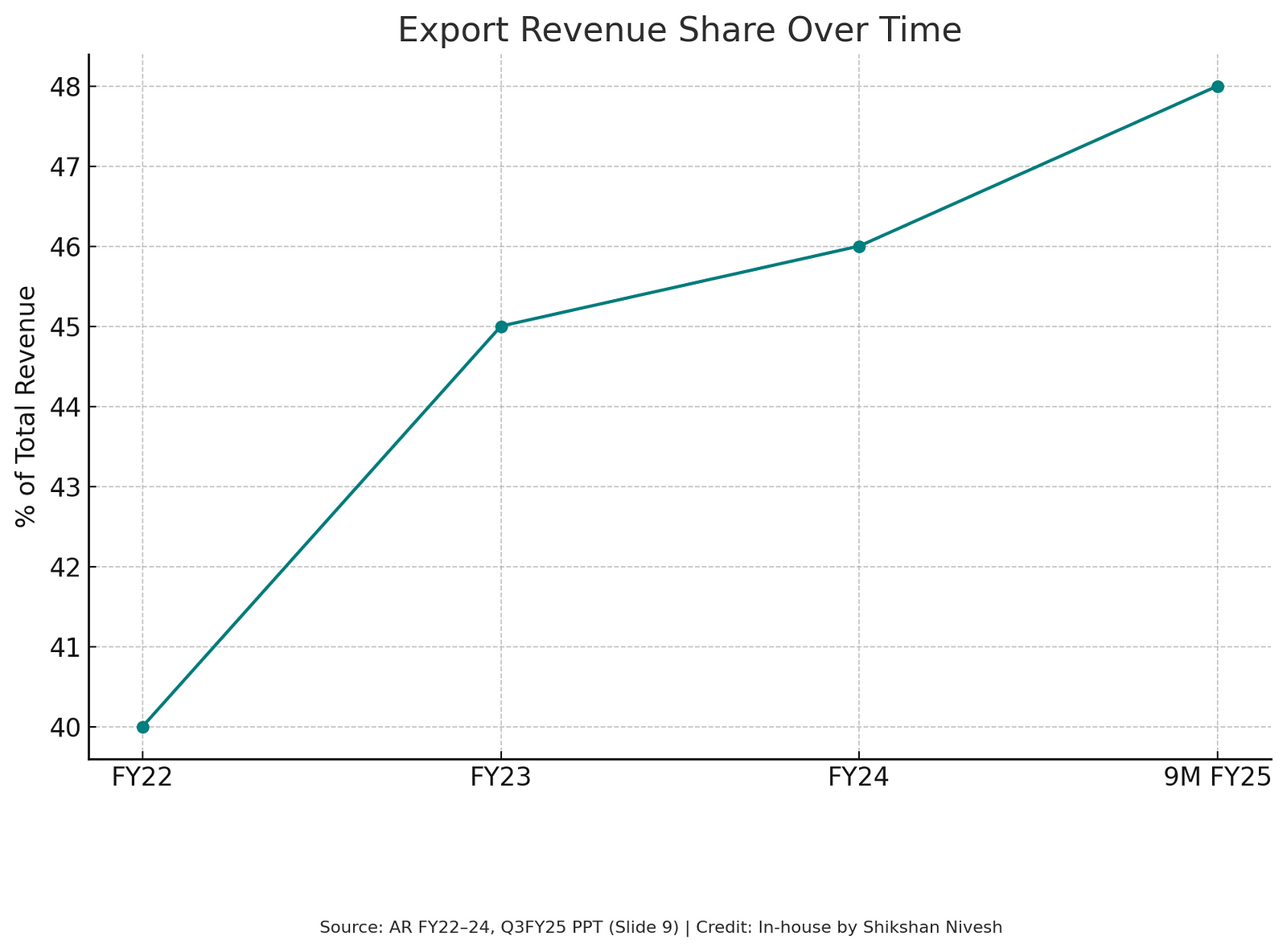

Export revenue used to be around 40%. Today? It’s 48% as of 9M FY25.

And it’s not just exports. It’s diversification :

- Middle East for EPC

- Africa for funding-backed turnkey projects

- India for steady O&M scale-up

This isn’t a one-country company anymore.

Growth, But with Realistic Expectations

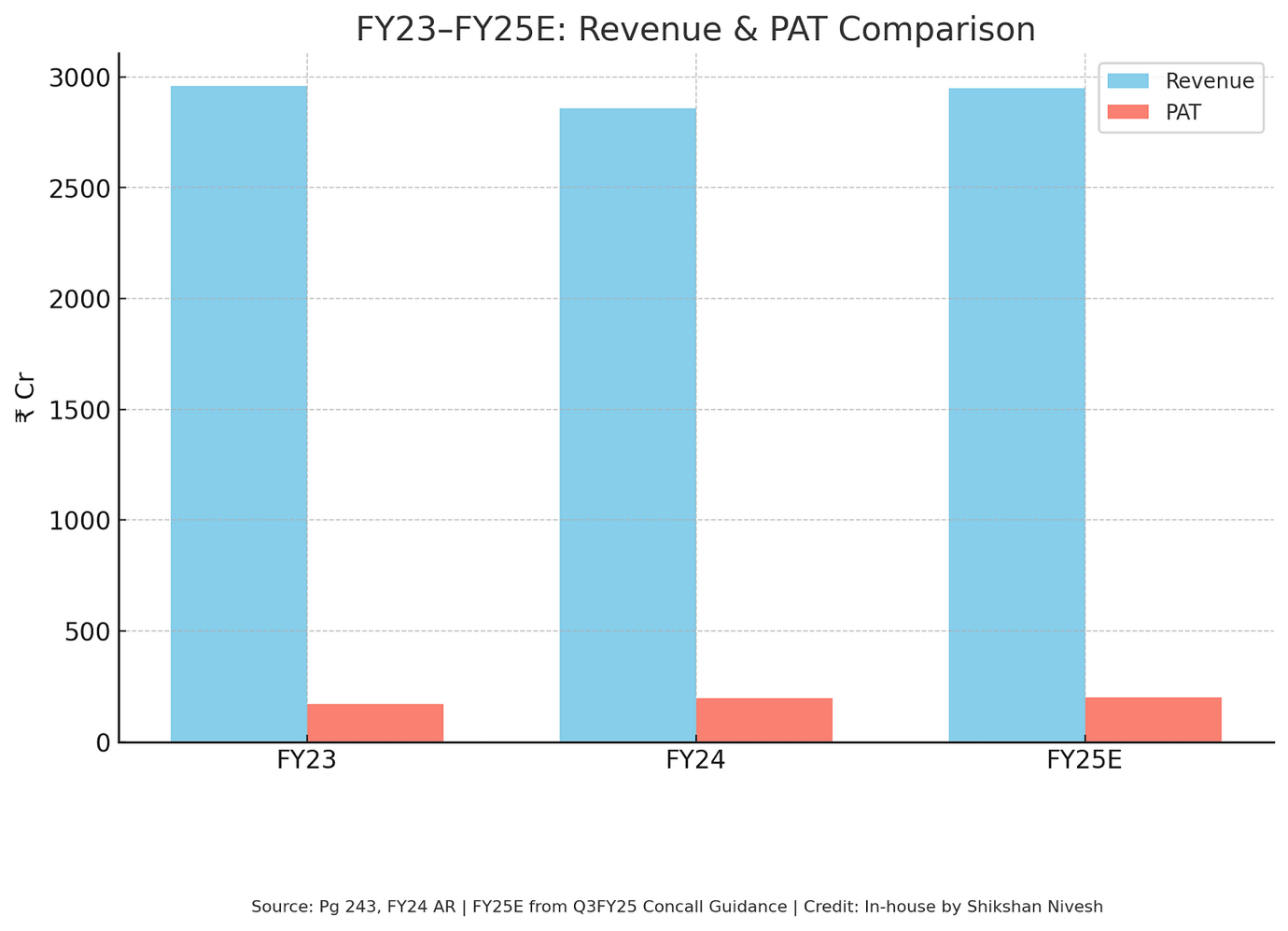

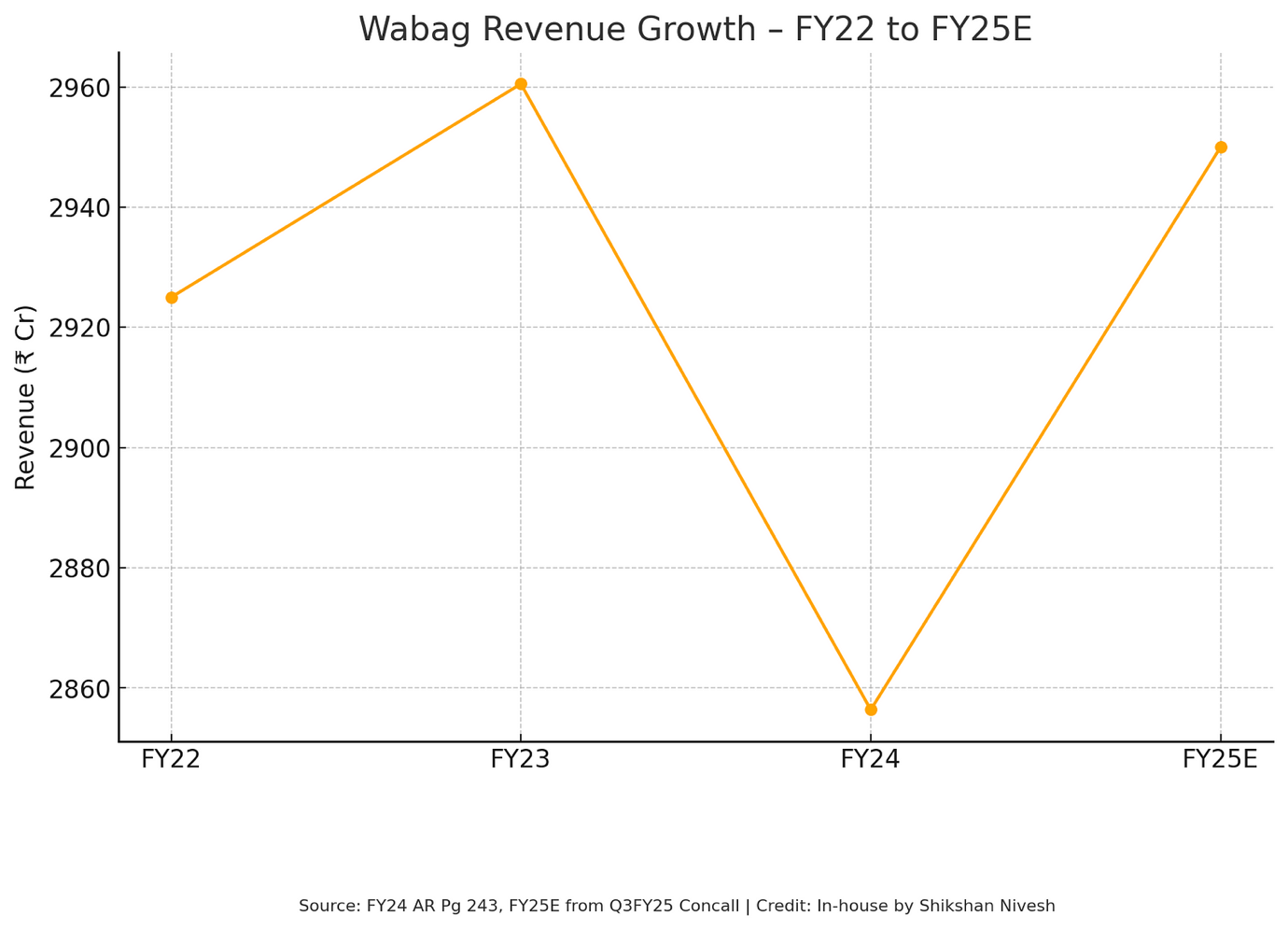

Wabag’s revenue hasn’t exploded.

From ~₹2,930 Cr in FY22 to an estimated ₹2,950 Cr in FY25E — this is slow and steady.

But underneath that topline is a stronger export base, better project discipline, and margin control.

So… Who Is This For?

This isn’t a “next multibagger.”

It’s not the flashy momentum play.

But it is one of the most execution-driven infra firms I’ve come across.

If you like :

- Quiet compounding

- Export-driven infra with annuity buffers

- Low hype, high clarity models

Then Wabag is worth watching.

Just don’t expect fireworks. Expect fulfillment.

Written by Shubham Borkar | Research & Insights by Shikshan Nivesh

[Educate · Analyze · Invest]

Disclaimer: This article is for educational purposes only. It is not investment advice. Please do your own research before making any investment decision.

Sources & Disclosures :

- FY24 Annual Report

- Q1, Q2, Q3 FY25 Investor Presentations

- Q1, Q2, Q3 FY25 Concall Transcripts

- PEG Ratio — calculated manually.

For more insights, follow Shikshan Nivesh :

🔗Visit us on : Shikshan Nivesh

🔗 X : @ShikshanNivesh

🔗 LinkedIn : Shikshan Nivesh

🔗 threads : @shikshan_nivesh

👉 If you found this helpful, share it with someone who’s tracking India’s growth story or looking for simple, research-backed investing insights.

Leave a Review